New payment options!?

It’s striking to me when I sit and think about how technology has changed the concept of money throughout my life – especially over the last 20 years. When I was young I remember being blown away by the concept of reputation-based goods acquisition… or buying something on credit. The more I thought about the more dangerous of a concept I realized it was. While it seems like you get something for free and are able to get instant gratification for goods or services you may not necessarily be able to afford, the bill of payment always comes due.

Back then it was taking a piece of plastic that was pressed to have numbers on it (credit cards), that someone would use a slider to imprint a copy of those raised/pressed numbers on the plastic card to a mix of plain and carbon paper. I thought that was super neat technology at the time. Shortly after in the 80s we had the magnetic strip readers added to mainstream readers which seemed like magic to me at the time. I know that it was invented in the late 60’s, though growing up in the 80s I remember when magnetic readers took over the shopping areas and the slider went the way of the dodo.

Over the last 10 years or so credit cards now have microchips installed in them that contain the account numbers that can be sent electronically that used to require manually written down or using the slider to copy down. There are new monetary technologies coming out being used all the time and it’s difficult to keep up with them, this post attempts to briefly look at a few up-and-coming trends and approaches for how we transfer money.

EMV/Chip and Signature/Chip and Pin?

The EMV standard or Europay, Mastercard, and Visa standard is a payment standard developed by those three companies to create the possibility of using an integrated circuit to transfer account information / secure transaction authorization instead of relying on the magnetic strip.

My personal first exposure to Chip and Pin EMVs was in the fall of 2006 when I visited London for a consulting engagement for work. I thought it was very neat that you could secure your purchasing information with a passcode that would prohibit or deter theft. The US was a bit behind this European trend but did eventually come stateside in the form of debit cards.

It wasn’t until the 2010s that I saw Chip and Signature come to my credit card – it has honestly always baffled me why we’d rely on a signature as a form of authorization instead of deploying the PIN universally. I know some credit cards allow you to flex between the two, I honestly don’t see the value in the signature and would lean toward a pin for better security. While I understand using a PIN isn’t 100% secure (nothing is), it’s an improvement over signatures.

NFC / Contactless Payment?

NFC or near field communication is an interesting short-range communication standard that can communicate a bit of data (100-400kbps) over a small distance (4cm/1.4in) – perfect for being able to transmit account information for payment. Also perfect for sanitary reasons as at the time of this writing we’re in the second year of restrictions due to the global COVID-19 pandemic.

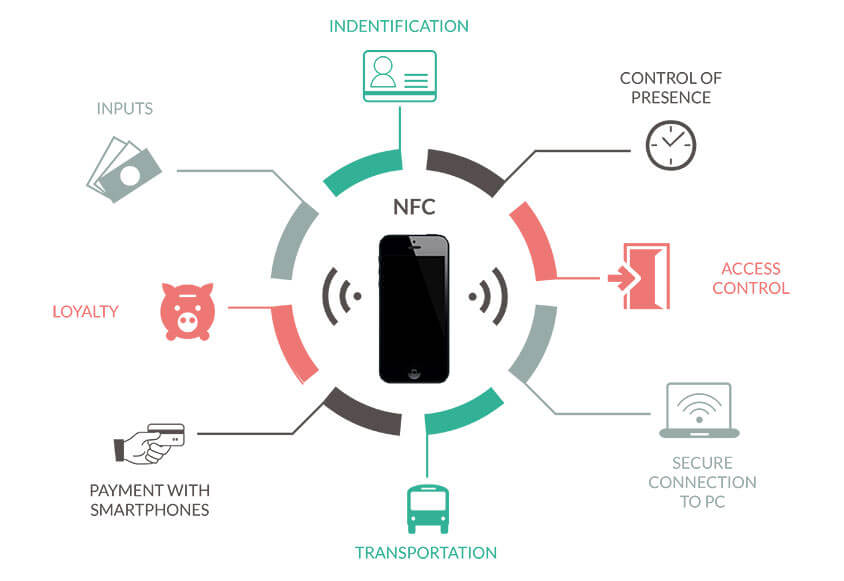

NFC has other applications outside of payments, for a quick share of photos, identification, door access for businesses, and other data that can be standardized and used.

As with all payment methods, NFC is not foolproof and doesn’t guarantee a secure connection, and is vulnerable to certain attacks (such as man-in-the-middle). Though an interesting application is a combination of NFC with an EMV credit card. The credit card I’m presently using and was issued a year or so ago is a combination EMV chip and signature w/ NFC, so any time I see the NFC logo I can just tap my credit card to the machine instead of using the chip. It’s much faster and more efficient for quickly paying than the chip process in my opinion. The best implementation in my mind is the NFC integration with smartwatches – I personally have used a Fitbit watch with NFC and when setting up Fitbit pay with my credit card I don’t even need to touch my wallet for any storefront that has that handy NFC logo on the payment terminal (which at the time of this writing is almost everywhere I go).

Digital Wallets and Services (Apple Pay/Google Pay/Venmo/PayPal/etc.)

Digital wallets are essentially online services that consolidate financial information (that could even include certain coupons, driver’s licenses, health insurance cards, etc.) that can be used for payment with digital storefronts and convenience for reference-ability. These services also enable/work in conjunction with NFC-enabled phones to quickly pay for items. Some services even offer physical cards that tie to their digital wallet, some even have NFC enabled on the card.

I’ve personally not had a tremendous amount of use for a single digital wallet in the way I do for an actual wallet – though the technology is still developing. I haven’t seen a lot of value outside of some services I’ve referenced before (as Fitbit Pay for ensuring my watch works as a method of payment for NFC payments) as well as ease of checkout where you can easily pay with PayPal or Amazon pay or google payment online. I’ve never had a situation come up where I need to check my digital wallet for my driver’s license or health card information, and to me, it’s easier to reference my credit card from my actual credit card than to use my phone. Maybe I’m dating myself here as I still do carry a wallet.

One final item to consider with digital wallets/digital payment services is the security model vs standard credit cards. To make a payment with a credit card your credit card account information is transferred to authorize payment. While technology is improving for in-person EMV transactions for a different encrypted passcode for each transaction, digital wallets are more secure to me for online purchases. Think of it this way, if I had your credit card information by looking at your credit card (account number and CVV code) I could go anywhere online and make a purchase – I would need your username, password, and likely the second form of authorization (most common is a text message or email) to authorize me to buy something online with a digital service.

Cryptocurrency?

This is a really big topic that I could devote multiple posts on this piece alone, maybe I will in the future but for now the thing to know is that for most people – cryptocurrency isn’t viable for everyday transactions as a method of payment. Personally, I think I’ve seen one place I could pay with a cryptocurrency over the last year for the things I have purchased. Over the last decade there has been some growth in this space to be more viable and (what is frankly shocking to me) I’ve seen a few recent reports (here’s an example) on banks and other businesses betting on cryptocurrency for widespread consumer adoption but it’s not there yet.

At a high level, cryptocurrencies such as Bitcoin, Ethereum, and others (and there are a lot of them..) leverage a secure platform for what’s essentially an electronic ledger to track transactions and updates through a distributed computing model called blockchain technology. There are more potential applications to blockchain technology outside of a cryptocurrency (think passports, instead of stamping the countries you visit on a piece of paper in a controlled booklet it could be tracked on a secure electronic ledger as a transaction – i.e. ‘the blockchain’). Wrapping different security, communication, transaction standards, and approaches around blockchain essentially gives you the different cryptocurrencies. There are a lot of details I’m glazing over here, but at the high level for this discussion, I’m going to leave at that.

What’s next?

While I’m certainly not a fortune teller, it is fun to think about what the future of money and everyday transactions will look like in the future. The unregulated nature, discussions, and growth of cryptocurrencies over the last decade remind me of how the internet was in the early ’90s. I do think some flavor of blockchain-based financial security models will be integrated with everyday life at some point. I also think the model of credit card account numbers/CVV codes needs to be phased out in favor of more secure transaction-based authorization alternatives similar to how digital services like Venmo and Paypal operate.

Sitting back and thinking about how little cash I carry anymore makes me think cash will eventually be phased out, but maybe not in my lifetime. So what is the color of money in the 21st Century? Feels like the color of digital to me – whatever color that is.