What is Cryptocurrency

Over the last 10 years or so the term ‘cryptocurrency’ has increased in popularity to the point it’s a household name. Unfortunately, it’s not widely understood outside of what the news headlines talk about such as:

- It can be used for illicit transactions like buying and selling drugs

- People are making money off of it

Not a lot of people understand much beyond the headlines, so I’m hoping this post can help. Cryptocurrency is decentralized, which essentially means it’s not governed by a country, organization (i.e. financial institution), or legal authority. The buying power of cryptocurrency is largely set by a combination of the volume of users and the amount of cryptocurrency available (i.e. the law of supply and demand). Considering no level of regulation exists for cryptocurrency, the buying power can widely fluctuate and is considered a risky and highly speculative investment. To underline the risk, the country of El Salvador attempted to make Bitcoin (a specific and first cryptocurrency) the national currency. The move did not go well for them, check this article out from Fortune to learn more.

Cryptocurrency takes key technologies such as blockchain, peer-to-peer networking-based communication, as well as cryptography and builds on them. This combination establishes the framework of a fully electronic currency (see here for the founding document of bitcoin). Due to both the unregulated nature of the currency and cryptocurrency is still under active development, there is a severe lack of stability. The new-ness and active development mean that as many different currencies that can be imagined can be developed. As of this writing, there are over 17,000 different cryptocurrencies in existence (reference).

What is Cryptocurrency Mining

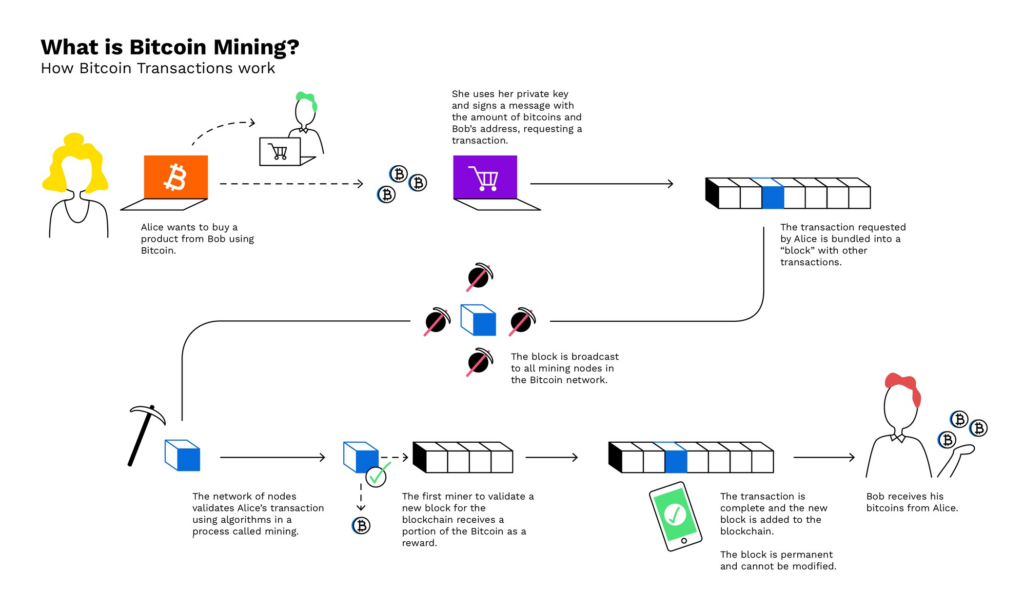

Cryptocurrency mining is the process of adding new cryptocurrency coins to the market. This process relies heavily on blockchain technology, so I’d recommend checking out this post before proceeding. Since blockchain technology is essentially a heavily secured ledger to record transactions, a fairly significant amount of processing is required across multiple systems to ensure the security and growth of the blockchain ledger as transactions are made.

Compare the above image for cryptocurrency flow against going to J.C. Penney to buy some jeans, if you’re buying with a credit card the financial institution (either your bank, capital one, etc.) and J.C. Penney’s computers are in play. Cryptocurrency relies on random (to us as users anyway) computer ‘work-horses’ to facilitate those transactions as part of a new encrypted ‘block’ on the chain to keep them secure with other separate computers checking work against each other.

If you want to mine with your computer (there are ‘idle mining’ programs that will mine cryptocurrency when your computer isn’t in use), you would essentially be submitting your processing horsepower to facilitate complicated encryption algorithms to create new transaction blocks on the blockchain.

Why Are People Mad at Cryptocurrency

If you’ve heard of cryptocurrency before now, you’ve probably heard that some people are mad at it. Here are a few reasons why with some additional information.

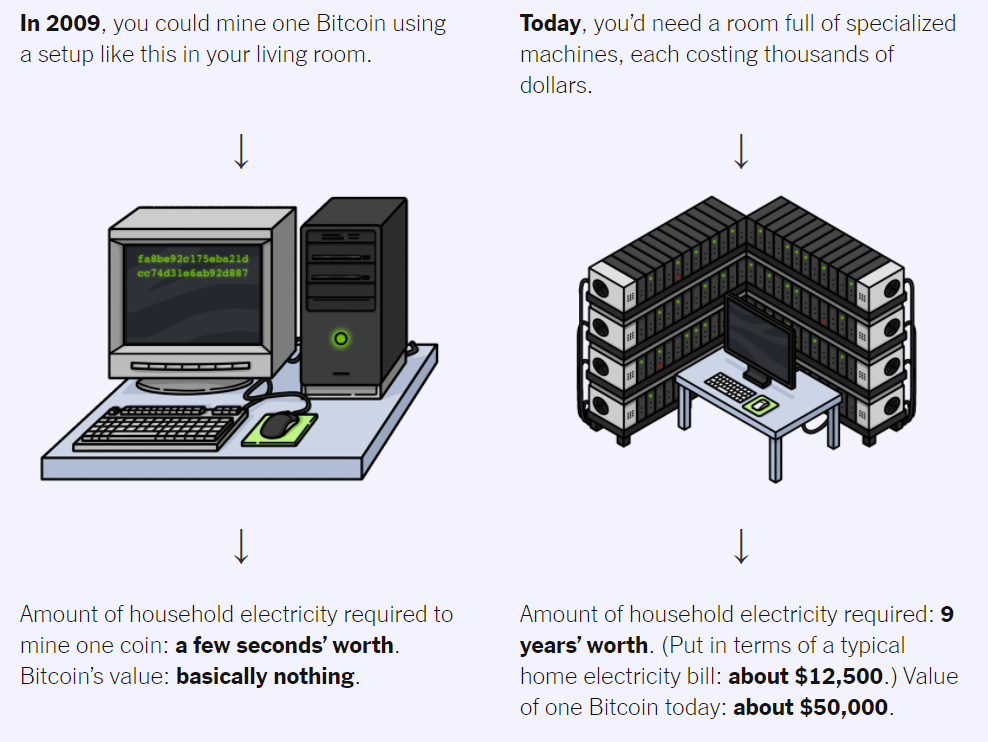

- Energy usage and power efficiency – the amount of energy used is not considered efficient. There is an active discussion between ‘proof of stake’ and ‘proof of work’ – i’d recommend checking out this article for more information on it which is trying to address the concerns here.

- Illegal activity payment / hard to trace – Law enforcement has a challenging, low paid and thankless job. Cryptocurrency makes that job more difficult as it’s largely considered very challenging to trace funds in cryptocurrencies. Cash can be traced to a certain extent, cryptocurrencies can as well, it’s just more difficult. This article goes in depth on the topic.

- Gaming hardware and electronics shortages – Cryptocurrency miners were causing supply issues before the COVID-19 pandemic, though the supply chain issues coupled with cryptomining has made the situation much worse. Powerful graphics cards have the ability to do complex mathematics very quickly and are desired by crypto-miners for that puprose. Miners use ‘mining farms’ as pictured above to get the most money as possible out of each computer and run them 24/7 making them, literally, money making machines. PC Gamer has a good article on this here.

- Video games and background mining processes – Video game companies are betting big different areas of NFTs and cryptocurrency. Here’s a bit more on the direction some games are taking. Also, Norton Antivirus is wanting to invite people to mine crypto for them – more here.

- Transaction speed – This is considered one of the larger barriers for adoption, bitcoin has between 5 and 7 transactions per second vs something like Visa which has roughly 25,000 transactions per second based on some research i’ve done (here is a good article about transaction speeds across different financial instruments).

What are the Benefits of Cryptocurrency

- Privacy / Freedom – The amount of data collection and frankly lack of privacy the 21st century has brought raises concerns. While cryptocurrency is not untraceable, it is incredibly challenging to trace granting a feeling of a bit more privacy and freedom.

- Early adopters are making money – Early adopters and entrepreneurial individuals have made quite a bit of money by jumping on board the crypto-craze. Here’s an article that talks a bit more about it.

- International currency – Cryptocurrencies could, in theory, create a recognized international stable currency that everyone agrees on. The currency of the future… Well, i’m not holding my breath that everyone will agree on a single currency in my lifetime but cryptocurrency as a technology does lay the ground work for a potential singular currency that could be recognized and used to buy goods and services across the globe. Some countries’ central banks are trying to create their own cryptocurrency hoping it will catch on.

What’s Next for Cryptocurrency

No one really knows what the future will hold, what follows are some of my perceptions. Here is an article from Time on what they think. I personally think the technology will continue to evolve (similar to the conversation of proof of stake vs proof of work, additional tweaking of the framework to smooth out the rough edges and barriers) and as it evolves a lot of money will be made and lost. I think of this as similar to the 49er gold rush in the 1800s. Did some early adopters make money? Absolutely. Did all, most, half, or even a quarter make money (or enough to be worth it)? Not really.

A lot of the cryptocurrency discussions seem to be very near-term (within a handful of years) viability (or quick-buck) focused vs long-term stability. I struggle seeing how widespread adoption will be possible, or the people going head over heels investing in a specific cryptocurrency today will do well long term. This is just my opinion and would encourage anyone to take a broader look at the conversation around crypto to form their own opinion!