Credit Cards

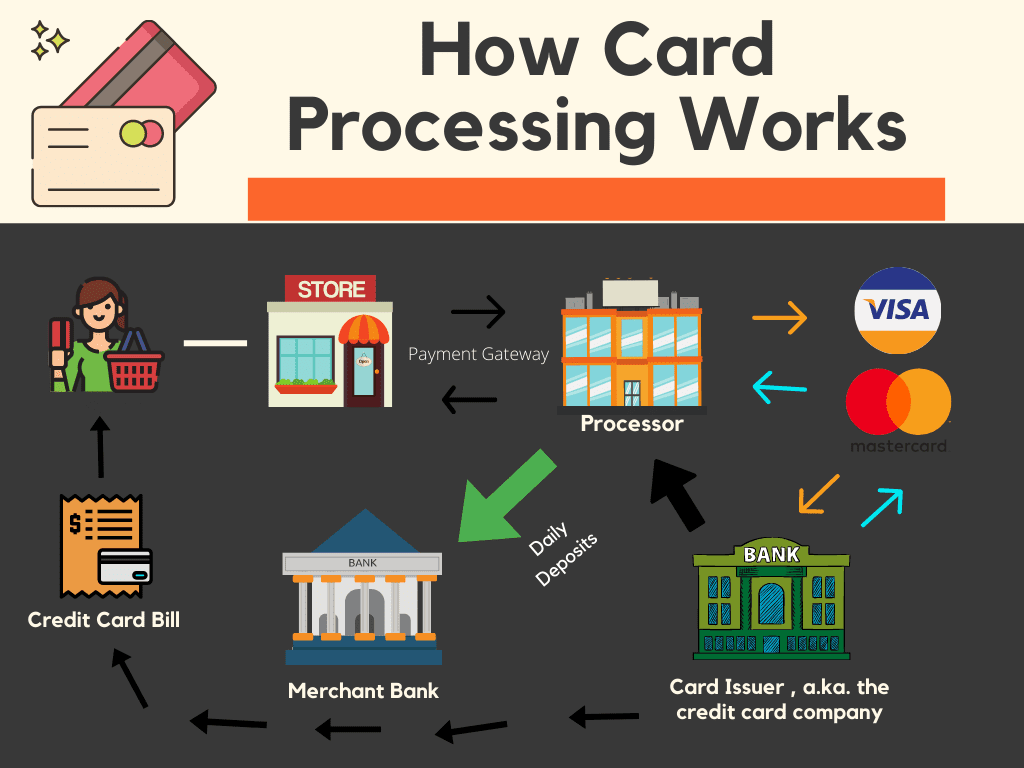

Most people don’t spend a lot of time considering how credit cards work (debit cards are different and tie directly to your bank’s checking account), it’s either just a handy thing that allows people to buy items quickly and easily or the most anti-consumer monstrous vampire to an individual’s finances ever conceived by humans. When you break down how many organizations are in the mix, and how much time it takes to complete a transaction the process feels old-fashioned and outdated. At a high level, credit card companies function by charging merchants ~3% of the price of a good or service. Merchants plan for this and build that 3% into the cost of the product or service. Behind the scenes, the credit card company tabulates a presentation of all charges to you, the credit card holder, to pay within 30 days. If payment is not received within 30 days from the billing date you’re charged an interest fee compounded daily (some compound hourly, more on that below). Let’s take a look at how the money flows.

Merchant’s Perspective – Breaking Down the Fees

Let’s take a quick look at the players:

- Merchant Bank – The bank the merchant uses and is paid for the purchase.

- Credit Card Network – The name associated, like Visa or Mastercard.

- Credit Issuer – The organization that issued the card to the consumer, pays the merchant and will bill the consumer.

- Processor – The organization that communicates with the bank and issuer to facilitate the sale transaction.

The fees at the point of sale:

- Interchange Fee – The largest fee and goes to the credit card issuer, usually a bank which covers reward programs, cost of extending credit and fraud protection.

- Assessment Fee – This is paid to the credit card network (i.e. Visa, MasterCard, etc.)

- Payment Processor Fee – This is paid to the processor who facilitates the transaction

The total fees range from 1.5% to 4% of the transaction, it fluctuates based on the network chosen (i.e. American Express, Visa, MasterCard, etc.).

Timeframe of Credit Card Processing

Here are some details, albeit boring but important to understand. At the point of sale, the credit card processor initiates the transaction from the merchant, they then facilitate communication electronically with both the card issuer and the merchant bank to begin to authorize the transaction. If the credit card holder is approved for the amount of the transaction then the sale of the good or service is completed while processing continues and the merchant gets paid.

General timeframe from point of sale:

- A few seconds – Time for credit card authorization to process and complete the sale

- End of Day – time for the merchant to get paid, usually in batches for the day’s credit card sales

- Up to 3 business days – time for the credit card transaction to post to the credit card holder’s account. This takes up to 3 days as banks exchange money and the credit card issuer is notified once complete and the transaction moves from pending to complete.

- 1-30 days – Billing date to the credit card holder

- 30 days – Time frame for the credit card holder to pay the credit card issuer

While the merchant is generally paid within 24 hours of the sale of goods or services, the credit card company carries that debt for up to 60 days, depending on when the charge lands on the billing cycle, and when the credit card holder chooses to pay their bill. That leads us to how the interest works and is calculated.

Consumer View – how credit card interest and rewards programs work

I’m going to use my credit card as an example, so take this for what it is, just a single real-world example. Credit card interest is used as a ‘fee’ for the benefit of essentially lending money to the credit card holder for a period of time. Interest is calculated based on an APR or Annual Percentage Rate, which is displayed when you sign up for a credit card and can be found as part of your account details. That APR is taken and split into a DPR which is a daily periodic rate, which is compounded against any debt you carry over month to month compounded daily (I’ve heard of some credit card companies compounding hourly). Generally, the oldest debt is paid first which only matters if you have a grace period set up when you started the account.

Taking my credit card as an example, my APR is 20.75%, which is .058% daily periodic rate (.2075/365 days of the year to arrive at a daily rate from the APR). So if I suddenly charged $10,000 to my credit card, after the amount was due for the billing cycle the $10,000 charge was in, the credit card company would charge me $5.68 every day until that principal 10k was paid. Not terrible, but if I carry that debt for a month for whatever reason, I would owe the credit card company about $170 per month. That’s not so great, especially if I struggled to make ends meet. If I carried the debt for a year, I’d owe over $2k – that’s pretty rough.

Are credit cards evil?

Personally, I don’t think credit cards are evil, but I do think they profit and prey on people’s bad habits and try to lure them in with the potential for rewards which generally pay ten cents on the dollar. If you can ensure you pay off a credit card in full every month and don’t incur the interest, a credit card isn’t terrible and the rewards can be nice for things you need to buy anyway. If you struggle with impulse control or don’t feel you make enough money to pay off your credit card each month? Stick with a debit card or take a look at re-evaluating your routine purchases, credit cards are not for you!